Calculate Your Irish CGT & Exit Tax

Free FIFO calculator for stocks (33% CGT) and ETFs (38% Exit Tax). Import trades and get estimates in seconds.

Start calculating in minutes

No complex setup. Just upload and go.

Upload Transactions

Import your CSV file from your broker. We auto-detect the format and map columns.

Review & Confirm

Verify imported data with our smart validation. Adjust any mappings if needed.

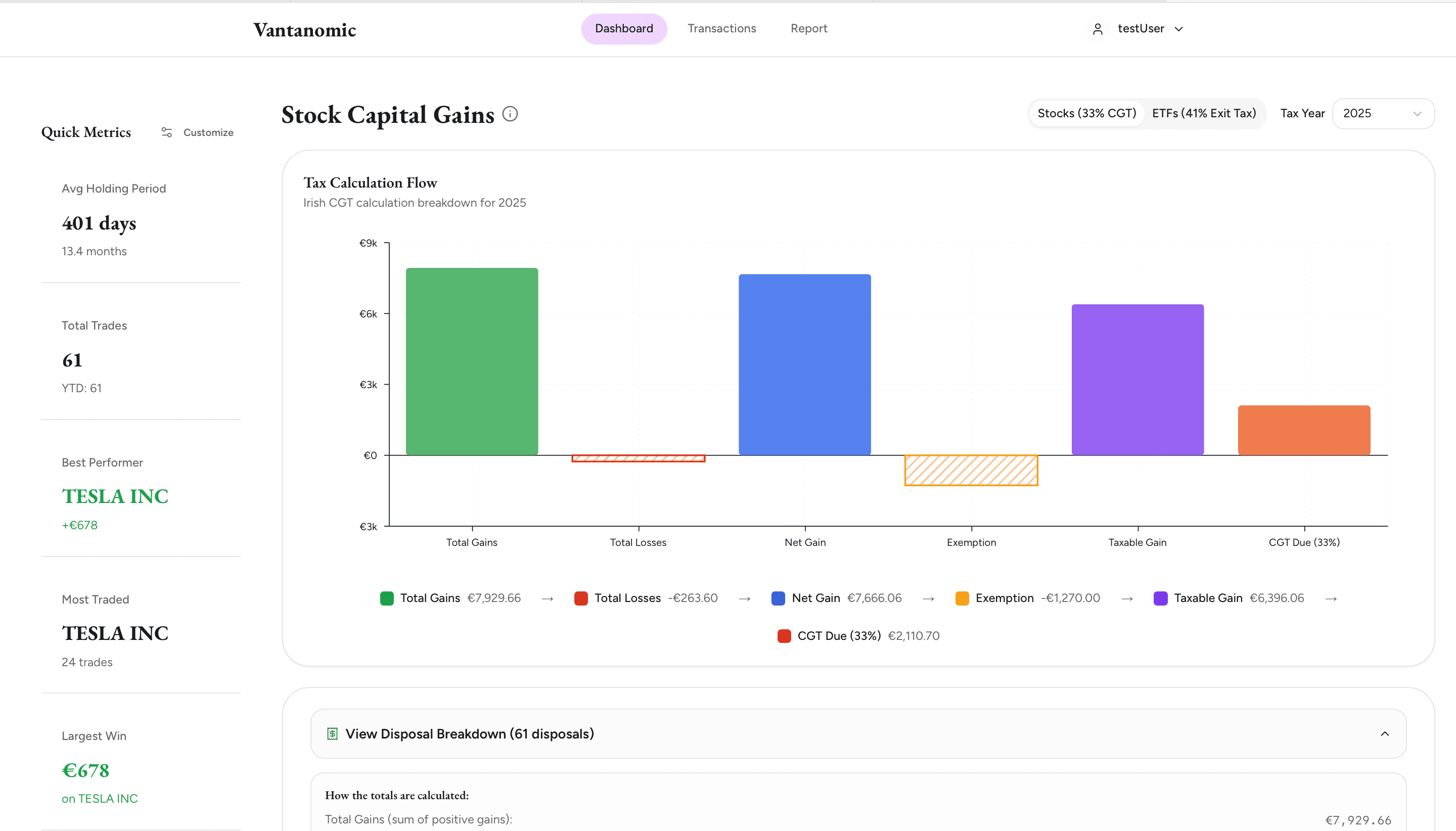

Automatic Calculation

Our FIFO engine matches trades chronologically and calculates gains using Irish Revenue rules for both stocks (33% CGT) and ETFs (38% Exit Tax).

Export Reports

Download annual tax summaries and disposal reports for both stocks and ETFs to help prepare your CG1 form for Irish Revenue.

2026 Irish Tax Deadlines

Don't miss your CGT and Exit Tax payment dates. Irish tax is paid in two periods throughout the year.

Period 2

December 2025 gains

January 31, 2026

Period 1

Jan – Nov 2026 gains

December 15, 2026

Form 11

ETF Exit Tax for 2025

October 31, 2026

(mid-Nov online)

CG1 Form

Stock CGT for 2025

October 31, 2026

(mid-Nov online)

Trusted by Irish Investors

Join investors across Ireland who use Vantanomic to estimate their tax obligations

“I had 3 years of trades across AAPL, NVDA and a few others. Uploaded my Degiro CSV and it matched every sale to the correct purchase lots automatically. The year summary breakdown is exactly what I needed for my CG1.”

Mark D.

Retail Investor, Dublin

“I was confused about Exit Tax vs CGT for my ETFs. Vantanomic automatically applies the right rate based on where the fund is domiciled. Really helpful.”

Sarah K.

ETF Investor, Cork

“The CSV import from Degiro worked perfectly. Mapped all my trades in seconds. Great for anyone who dreads the end-of-year tax scramble.”

James O.

Active Trader, Galway

Frequently Asked Questions

Common questions about Irish CGT, Exit Tax, and how Vantanomic works